Vital to note, car insurance coverage premiums are separate from your insurance deductible, which is the dollar amount you should pay prior to your insurance will kick in. All sorts of insurance require you to pay a costs, not simply car: property owners, life and also occupants insurance likewise call for premium payments. Exactly How are Car Insurance Premiums Computed? Insurance policy firms consider numerous variables when setting auto insurance policy premiums.

As an example, a 16-year-old child in a new sports cars and truck will certainly pay much higher insurance policy costs than a 40-year-old female in a terminal wagon. This is since the young boy is most likely to be in an accident, and his auto will be much more costly to fix if he enters one.

Right here are some details your insurer might think about when setting your premium.: Your age, sex and also where you live.: The more accountable you have remained in the past with your money as well as behind the wheel, the reduced your premium (automobile).: Newer, faster as well as more costly vehicles have higher premiums throughout the board.

No hassle. No concealed expenses. Reducing Your Insurance Premium Obviously, some of these factors are more challenging to alter than others, as well as some can't be altered at all. It's not practical to transfer to a various city Click to find out more or transform your age simply to conserve cash on cars and truck insurance. You can generally customize your insurance policy to fit your requirements and also your budget, so long as you stay within the insurance policy requirements in your state.

It is essential to have a mutual understanding of to ensure that you just pay for coverages you require (cheap auto insurance). Inevitably, every insurance policy business weighs variables in different ways, so to see who will certainly provide you the very best rates.: The Difference Between a Quote and a Costs When you obtain an insurance policy quote from an insurance policy firm, that's a quote of just how much the firm will certainly bill you for insurance coverage.

Lots of insurance provider will let you select exactly how typically you want to payand you'll typically obtain a "paid completely" price cut when you pay pay more upfront - insure.: However, sometimes, you might be needed to pay your entire term upfront. This is particularly typical if you're considered an at-risk driverfor example, if you previously let your insurance coverage lapse or you need an.

What Happens If You Don't Pay Your Car Insurance? Fundamentals Explained

When Do Car Insurance Policy Premiums Increase? Cars and truck insurance is typically marketed in either six- or 12-month terms. Long your term is, your insurance prices will stay the very same for that term unless you make a modification to your policy, such as if you acquire a brand-new automobile or move to a brand-new home.

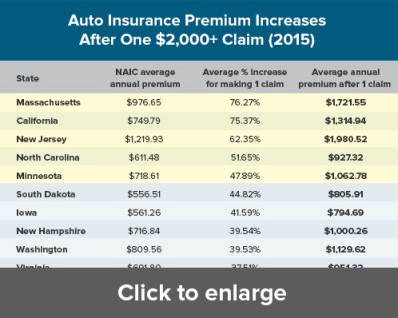

If you were associated with a crash or were captured speeding, your prices could boost; additionally, if you took a risk-free driving course, your price may decrease - cheap car insurance. Insurance companies are likewise frequently changing their versions for just how much to bill for insurance, so it's possible your price will certainly fluctuate with no adjustments in your driving condition in any way.

If you're new to the globe of automobile insurance policy, you may be questioning: What are vehicle insurance policy premiums? Your premium is what you pay your insurer in exchange for automobile insurance each coverage period. cheap car. In this post, we at the House Media reviews group will discuss what automobile insurance policy costs are, how they're determined, methods to reduce your settlements as well as more.

Our review group has actually investigated and also examined the finest auto insurance coverage firms in the sector to bring you the top referrals - low cost auto. Automobile insurance premium introduction A vehicle insurance policy costs is another word for your vehicle insurance bill. It is the quantity you need to pay to maintain your car insurance legitimate.

Cars and truck insurance coverage quote vs. premium An auto insurance coverage quote is not the very same thing as a premium. You may get to out to numerous firms and also get different rates for vehicle insurance policy. Those are quotes. The costs is the amount you pay each month (or 6 or twelve months) once you begin a policy.

This is because insurance firms obtain even more details that can impact your price when you start the policy. The rate might alter if you really did not enter your cars and truck's VIN into the quote kind or if you didn't add all house drivers back then - insurance company. Or, your price can alter if the company makes use of a credit-based insurance score to determine threat after you obtained the quote.

Not known Facts About 5 Ways To Keep Your Car Insurance Costs Down - Consumer ...

auto affordable auto insurance auto risks

auto affordable auto insurance auto risks

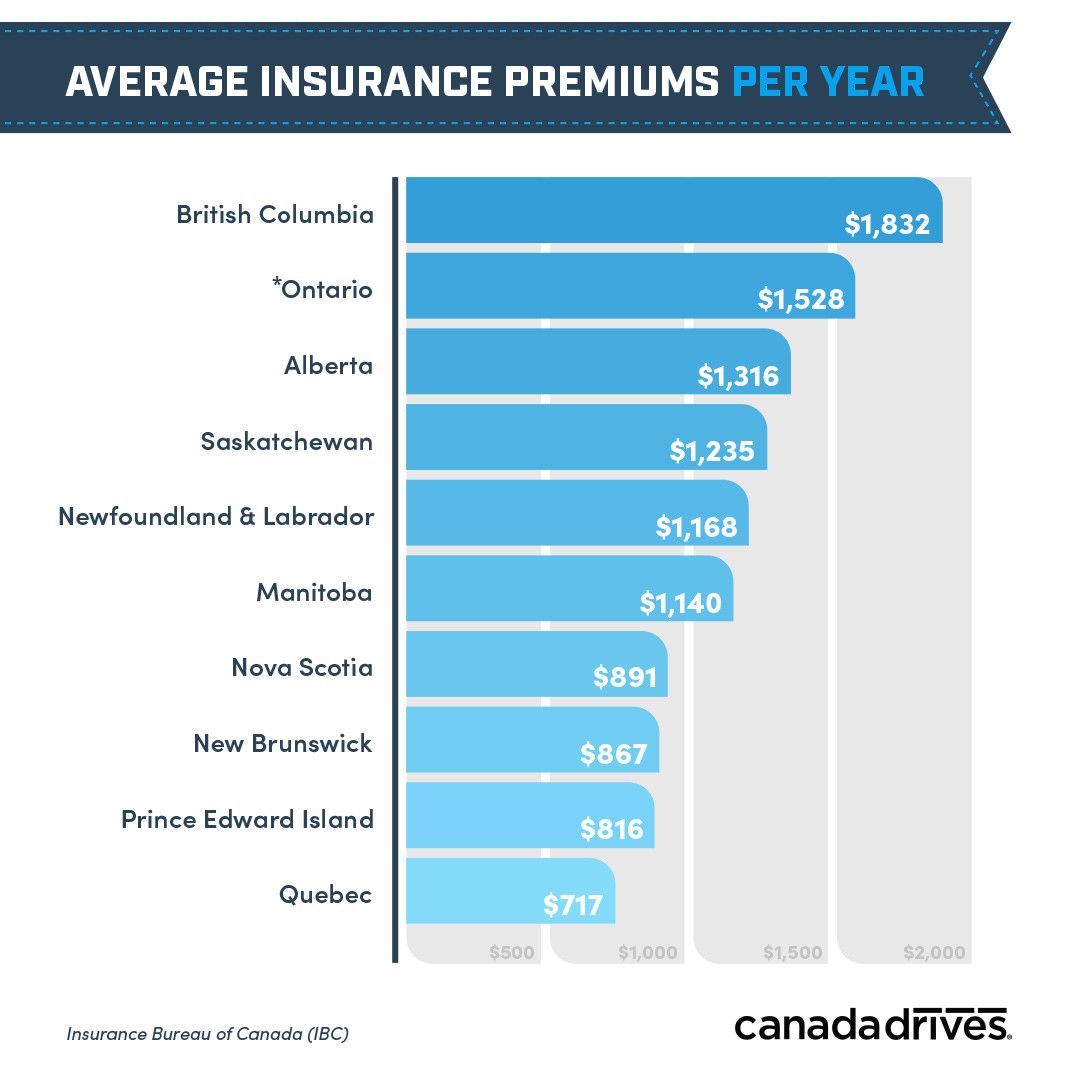

Your costs add to a local insurance pool that is influenced by state regulations and total claims. Allow's claim storm season problems much more cars in your state than typical one year. You might see rates boost throughout the next period to compensate for the raised insurance claims. On the various other hand, if your state introduces brand-new regulation to control insurance policy expenses, you may see a reduced price in your next plan duration.

There is no typical automobile insurance coverage premium for every motorist. These prices are extremely individualized, and also each insurance firm determines automobile insurance coverage premiums in a different way.

You might locate that you can conserve a considerable quantity by changing insurers. Take a vehicle driver security training course: Lots of insurance providers supply discounts for completing a state-approved vehicle driver safety program. These programs are normally six or eight hrs, and some states mandate that insurers supply price cuts if you complete one. Pick usage-based insurance coverage, if it can profit you: Several insurers provide usage-based price cut programs.

insured car low-cost auto insurance insure car insurance

insured car low-cost auto insurance insure car insurance

Our method Since customers count on us to provide objective and also precise information, we developed a thorough rating system to formulate our positions of the best car insurance provider. We accumulated information on loads of automobile insurance policy carriers to grade the firms on a wide variety of ranking factors. Completion outcome was a general rating for every carrier, with the insurance companies that scored the most factors covering the checklist (cheap insurance).

Coverage (20% of complete rating): Business that offer a variety of selections for insurance policy protection are most likely to satisfy customer needs - credit. Reputation (20% of complete score): Our research study group thought about market share, scores from market specialists as well as years in business when offering this rating. Accessibility (20% of complete score): Car insurance coverage firms with higher state accessibility as well as few eligibility requirements scored highest possible in this category.

The cash we make helps us provide you access to free credit rating ratings as well as records and helps us develop our various other great devices and educational products. Payment may factor into how and where products show up on our platform (and also in what order). But given that we typically earn money when you find a deal you such as and get, we try to reveal you provides we think are a good suit for you.

Unknown Facts About High Risk Insurance - Safeauto

Of course, the offers on our platform don't represent all financial products out there, but our objective is to reveal you as many excellent choices as we can.

low-cost auto insurance vehicle insurance cheap perks

low-cost auto insurance vehicle insurance cheap perks

Need automobile insurance policy? Your premium is the amount of cash you pay to an insurance firm to give insurance on your automobile. Your cars and truck insurance policy premium might be paid monthly, every 6 months, and even just yearly, relying on the repayment choices your vehicle insurer uses. In exchange for your automobile insurance policy premium, your insurance coverage supplier will give you with the insurance coverage outlined in your insurance coverage policy.

In every state except New Hampshire, you're needed to have a minimum quantity of protection. cheap. This can assist secure your wallet by covering costs approximately the insurance coverage limit detailed in the policy you choose as an example, to cover injuries or home damages you trigger an additional driver in an accident.

The cost of your cars and truck insurance premium can depend upon a variety of different factors some of which you can manage (for instance, where you live or the kind of vehicle you drive) and also some that are out of your control (such as your age). Spend for insurance that thinks about how you drive, not just that you are Right here are some of the elements that can influence your automobile insurance prices.

And selecting high protection limits and/or low deductibles will likely increase your price of vehicle insurance coverage, too. Are you an experienced motorist with no imperfections on your document? Or do you have a few tickets as well as a crash or more in your driving history? Even the quantity of time you have actually been driving can impact your insurance premium.

More youthful vehicle drivers commonly pay much more for insurance policy protection because they have much less experience on the roadway as well as go to greater danger of being included in a crash. When identifying your costs, insurance provider consider a couple of aspects associated with your automobile, such as the expense to repair it and total safety and security document.

Not known Facts About Car Insurance - Get A Free Auto Quote

The greater the deductible, the lower the premium. With a $500 deductible, your costs cost would certainly be less, however you pay the very first $500 anytime you have an extensive insurance claim.

Credit scores racking up is used by many insurance policy firms as a ranking factor for car insurance policy.

A cars and truck insurance coverage costs is the amount you consent to pay to the insurance provider in exchange for car insurance policy coverage. Auto insurance policy costs are based on lots of aspects, including the kind of insurance coverage you pick, your age (except in Hawaii), driving background, the lorry's make, version as well as age and also the insurer you choose.

What is a car insurance premium? An auto insurance policy premium is the yearly expense of your vehicle insurance plan and also is sometimes called an insurance coverage price. The majority of vehicle providers supply six-month policies, but some offer a yearly policy. You can pay everything at as soon as or monthly, which might feature additional installment costs.

As long as you continue paying the automobile insurance coverage costs in a timely manner, your insurer guarantees to safeguard you and your vehicle in the occasion of an accident or other protected loss. When you stop paying the costs, the insurance company deserves to terminate your plan after a specific period - automobile.

Your costs and your deductible are 2 separate costs. An out-of-pocket cost will certainly be subtracted from the quantity your insurance company pays to cover the insurance claim.

Getting My Susan Keezer: The Wonderful World Of Auto Insurance Premiums To Work

insurance trucks credit score affordable

insurance trucks credit score affordable

What alternatives do I have with my auto insurance policy premium? You have several choices with your car insurance premium (low cost).

trucks accident insurers car insurance

trucks accident insurers car insurance

Each firm has its own collection of discount rates used, and also lots of can be piled together for additional savings - dui. There are discount rates certain to students and young motorists, taken into consideration risky vehicle drivers contrasted to various other age and also normally more expensive to insure. You can get in touch with each insurance company to learn which discounts it uses.

There are a variety of variables that suppliers utilize to calculate your special rate. A few of these aspects you can regulate, as well as others you can not. Right here are some of the important things that influence your vehicle insurance costs: Your age and also state, Exactly how old you are and also where you live are 2 of the biggest elements that influence your car insurance costs.