cheapest car insurance insurance company auto suvs

Solution: (A) An insurer may refund a charge if a solitary car plan is retracted without having ended up being efficient. (B) An insurer might reimburse a charge if a car included in a multi-vehicle policy is ultimately removed before the coverage for that automobile comes to be reliable even though the policy itself stays active.

An insurance provider ought to reveal the cost as a separately identified quantity on a costs expense, the declarations web page of the policy, or in a different composed communication to the insurance policy holder (car insurance). Solution: An insurance firm needs to keep its records in such a fashion that amounts written and also gathered from each policyholder can be identified.

Response: No, the fee is not subject to superior tax obligation. Solution: All queries should be emailed to: [e-mail safeguarded].

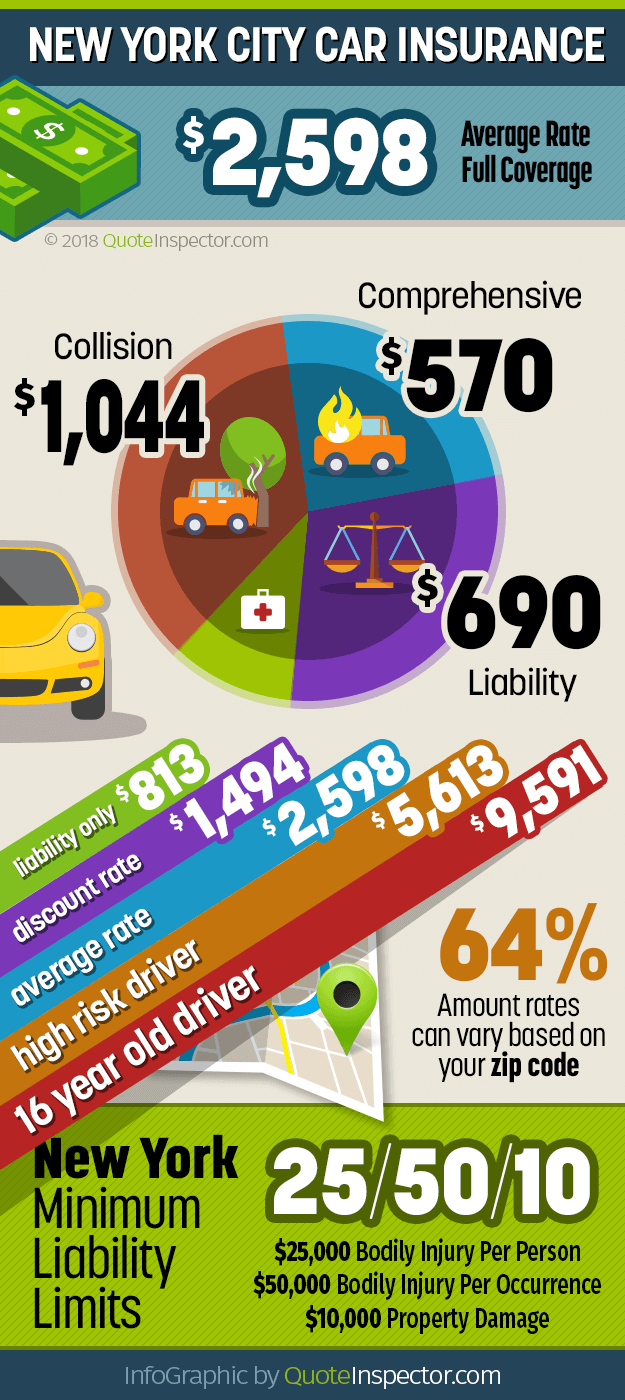

Brooklynites have the highest possible car insurance coverage rates in all of New York City State, according to a brand-new research (liability). Picture using Pexels With brand-new studies exposing that automobile insurance prices are at an all-time high in the united state, Brooklynites have additional factor to grumble their rates are the highest possible in New york city state, where auto insurance rates have actually risen, over the in 2014, 62.

Contrast this with the insurance policy prices vehicle drivers pay in other components of New York state, such as Dutchess Area, where the typical expense is about $1,600 a year. Regarding a 3rd of Brooklyn's working population commutes to function, a possible factor contributing to the district's greater prices.

What's The Average Cost Of Car Insurance In 2020? - Business ... - Questions

According to the Zebra, there are 1. 4 million motorists in New york city City (auto). Related Articles.

The average New York property owners insurance coverage price is $1,309 per year, being available in simply slightly much more pricey than the nationwide number of $1,211 every year. If you're trying to find the most affordable price on house insurance policy, think about obtaining quotes with a skilled professional.

In this article, Part 1 discusses the relevance of understanding your monthly charge, Part 2 shows you just how to determine month-to-month prices, and Part 3 discusses how to compare the results. Part 1 of 3: The value of understanding your monthly premium, There are a couple of reasons that you may wish to know what your month-to-month insurance coverage cost would be. vehicle insurance.

If you pay every year and Find more info have no installation or various other costs, you divide your annual premium by 12. (Annual premium-discount)/ 12 months = monthly price, Your month-to-month auto insurance policy price, if paying in full in advance, would certainly be $91.

According to our research study, the national typical representative auto insurance policy rate is $1,442 per year. business insurance. That amount is based on information from 9 of the biggest auto insurer in the nation. That being said, numerous elements determine a driver's auto insurance coverage costs, so the data in our research may not be a measure of the rate you pay.

Everything about Average Car Insurance Costs In New York - Smartfinancial

:max_bytes(150000):strip_icc()/how-much-does-health-insurance-cost-4774184_V2-f7ab6efc9c5042d3aedcbc0ddfc6252f.png) dui cheap business insurance laws

dui cheap business insurance laws

Progressive, Farmers, and Allstate have average prices that are much more pricey than the general national average. We did a detailed analysis of auto insurance rates for vehicle drivers across the country to locate the most affordable insurers in each state. The rates revealed here are a straightforward ordinary taken from representative motorist accounts, so your rates will vary.

Even within the exact same state, you could discover that rates alter in different ZIP codes. liability.

In New York, there more than 12 million drivers, which is why its roadways are the busiest in the U (low-cost auto insurance).S.And with this numerous chauffeurs on the roadway, there's even more opportunity for a vehicle driver to enter a mishap. So if you do drive as well as have a car, you need vehicle insurance coverage not just for your defense however also since it's mandated by New york city state law.

As well as for full protection, some drivers can't manage it - cheaper. So just how do you locate the best auto insurance policy in New york city that fits your demands and is fairly inexpensive? According to a Residential property, Nest research, the average price of a basic automobile insurance coverage in New York state is $2,115 a year.

The estimates work in learning what the typical individual with the ordinary car might obtain estimated. Nevertheless, you ought to look for your own quotes for individualized coverage as well as premiums. Outcomes might differ according to different metrics such as your driving background, credit rating, auto design, as well as safety and security functions to call a couple of.

Everything about Chrysler Capital - Auto Finance

cheaper cars cheapest auto insurance credit score vehicle

cheaper cars cheapest auto insurance credit score vehicle

All you require to do is download an application on your smart device and it will certainly start to track your driving routines. If you drive securely, the application after that computes a cash incentive - affordable car insurance. On top of that, you can earn reward factors when you avoid difficult stopping, maintain the rate limitation, and also more driving-related habits.

Rankings, J.D. Power: Rated fourteenth out of twenty-four vehicle insurance provider for customer satisfaction, In terms of general customer care, J.D. Power rated the business above average in a survey, AM Best Price: ALiberty Mutual Car Insurance Pros & Cons, Pros, Cons, Lots of attributes, In a J.D. Power auto insurance coverage study, the business is a little poor in consumer contentment, If you pay out $30 each year to a deductible fund, your insurance deductible will certainly be lowered by $100Limited accessibility of discounts, Online devices are simple to utilize, Greater than average grievances, Educators can receive cost-free automobile insurance coverage such as accident and personal residential property insurance policy, Geico: Ideal Vehicle Insurance with the Most Discounts, Editor's Ranking (5 Stars out of 5)Geico offers budget friendly complete insurance coverage vehicle insurance coverage in New York.

5 Stars out of 5)We recognize you enjoy driving your CLK GTR Roadster, one of the most restricted manufacturing that Mercedes-Benz ever built - cheaper car. Most times your Roadster is securely maintained in your garage, and if you have State Farm Collection Agency and Classic Automobile Insurance Policy, that's exactly where the firm wishes to keep your automobile.

We picked State Ranch for vintage cars because the insurer provides relatively competitive rates and protection alternatives for traditional autos. Rates is based on usage. If you just take your car for a spin once in a while, the rates based on use will certainly provide you a very luring discount.

44BBB: A+S&P: AAMoody's: AState Farm Auto Insurance Pros & Cons, Pros, Cons, Insurance coverage offered nationwide, Limited unique discounts for timeless automobiles, Rates based on use, NAIC score is 1. 44, which suggests the insurance coverage has obtained even more issues than the average car insurance business, Rates are equivalent to other classic and also antique cars and truck insurances, Travelers Insurance policy: Finest Automobile Insurance with Optional Features That Issue, Editor's Score (4 Stars out of 5)Travelers conventional car insurance has high marks for consumer satisfaction and also affordability.

A Biased View of Brooklyn Car Insurance Rates Among The Highest In The Nation

Certain, your premium will rise, however these 2 options seem necessary when you struck the roadway. The optional Responsible Motorist Strategy features accident forgiveness or minor violation mercy. car insurance. The optional Costs New Car Replacement is a top-notch add-on. Primarily, if you have a mishap and also your cars and truck is completed in the first 5 years you possess it, Travelers will provide you a brand-new model of the very same make.

AM Best, which ranks the financial stamina of insurance coverage companies to identify if they can fulfill their clients' requirements, provided Travelers the greatest rating of A++. J - insurance companies.D. Power asserts that the customer contentment score is 823 out of 1,000 when the ordinary vehicle insurance is 835. This means the company's reputation is somewhat listed below in contrast to various other insurance companies.

That's not what you want to hear when you purchase an auto policy from Progressive. 33 rating, which suggests the business has a higher-than-average customer problem rate.

Dynamic Automobile Insurance Coverage Pros & Cons, Pros, Cons, For those seeking a huge, reliable carrier, Average customer care rankings, Several ways to obtain a preliminary quote, Price cuts and also protection choices can vary in different states, Excellent monetary toughness rankings, Much more expensive than equivalent rivals, Amica: Finest Vehicle Insurance with a Conventional Policy That Has Attractive Integrated Benefits, Editor's Score (4 Stars out of 5)Amica has the most effective consumer fulfillment rankings as well as fewer customer issues than expected when contrasted to various other premiums that are of the exact same size (cheapest).

JD Power rating: "over ordinary overall."A - cars.M. Ideal: A++Criterion as well as Poor: AANAIC: Excellent, which indicates Chubb received much less complaints than average. Chubb Automobile Insurance Policy Pros & Cons, Pros, Cons, Great for high-net-worth clients seeking to cover costly vehicles, Excessively costly prices, Some settlements can be wrapped up on the same day, Expensive add-ons raise the rates, Lock and also key substitute protection without deductible, Does not concentrate on supplying low-cost insurance policy, Bad for buyers seeking the most affordable prices, In keeping with their affluent insurance holders, Chubb has little to no discount rates besides bundling, No online choice to obtain a quote, Nationwide: Finest Car Insurance Policy with Online Existence and Intuitive App, Editor's Score (4 Stars out of 5)Nationwide is all concerning simplicity.

A Biased View of How Much Is Fhv Insurance In New York City And How Do I ...

Furthermore, there's a different Nationwide app that you can make use of to track your driving, such as not speeding, and after that the business will offer you discounts for risk-free driving. Online, Nationwide's internet site includes a site where you can likewise pay a costs, handle your policies, and also file as well as track insurance claims.

Prices, We acquired rates for each business based upon qualities of the ordinary grown-up chauffeur in New York State looking for standard coverage in significant city and suburban locations. Our findings show that rates can differ considerably from business to company. Some insurance policy carriers provide a little bit much more in their basic coverage or provide even more discount rates, which add to value variation.

We took a look at how the prices compare to the remainder of the New york city state and significant cities such as Buffalo, Rochester, Yonkers, Syracuse, and Albany. The Ordinary Cost of Auto Insurance in New York, The expense of car insurance coverage varies depending upon the firm, where you live (whether it's country or metropolitan), and driving record.

Climate condition like extreme storms, winter storms, floodings, and also hefty snow project in New York as well as can cause boosted automobile insurance coverage rates. Minimum vehicle protection that's called for by law in New York State may not be adequate adequate to safeguard you against a mishap (insurance companies). It's undoubtedly better for New Yorkers to purchase insurance not for marginal coverage but instead for full coverage.

Given that there are a great deal of automobile insurances that cover New york city, your finest wager is to locate the appropriate business for you by comparing quotes from various insurance providers. By doing this you can obtain the ideal coverages that are essential to you and for the appropriate cost. Not having enough insurance means that you might need to pay out-of-pocket in case of a crash or injury.

7 Simple Techniques For How Much Is Car Insurance For 18-year-olds? - Coverage.com

cheaper auto insurance cheaper car insurance insurance affordable car

cheaper auto insurance cheaper car insurance insurance affordable car

You will have a lot more financial security as an outcome, and also which is why most auto insurers suggest higher limits. Minimum insurance coverage does not include comprehensive or crash protections, which pay for damages to your auto.

It makes good sense to fork over for added insurance coverage over minimum requirements if you have invaluable possessions to safeguard, such as a limited-edition cars and truck. If your responsibility protection is not enough when a claim is made versus you, the other or hurt driver can take you to court for financial problems that you will certainly need to gobble as well as pay (business insurance).

Property damages obligation (PD) covers repairs that you trigger to a person else's car or building. Essentially, it's something physical you demolish that does not come from you, such as the front of a residence or a structure, Comprehensive and also Crash Insurance Coverage, Comprehension and accident coverage are commonly packed together and also have the same protection limitations.